- Retirement

- Lifetime Webinars

- Retirement Planning Guide

- NZ Superannuation

- Retirement Income

Turn your savings into a retirement income designed to last your lifetime.

Lifetime Retirement Income can help you turn a lump sum (retirement savings) into a regular, tax-paid, fortnightly income designed to last for the rest of your life. So you can enjoy the lifestyle you deserve.

Lifetime invests your retirement savings, then combines your retirement savings balance with your investment returns and calculates your Lifetime Annuity Factor to determine how much income can be paid each year to last your lifetime with confidence. We manage your investment in a way that doesn’t just maximise investment returns, but also ensures that the capital base you have will indeed last you your lifetime.

Hear from Lifetime Income Customers

How does Lifetime Income work?

We have created an Annuity Factor that takes into consideration your gender, age, tax rate, and what we expect future investment returns to be at any point in time.

We combine these all together and create a single number which is your Annuity Factor. We then apply this to your account balance and that tells us how much income you can draw down each year, paid fortnightly, after tax, and be confident it will last you a lifetime.

The Lifetime Annuity Factor is all about your life expectancy. Everybody is different, everybody lives a different length of life. So when we calculate your annuity factor, every year we check in on your birthday to make sure you can always have that confidence your income will last your lifetime.

What are the benefits of Lifetime Retirement Income?

A Regular Fortnightly Income: Lifetime pays you an income each fortnight, the same week as NZ Super, so you can continue paying the bills.

Spend with Confidence: Each year, Lifetime calculates an annual income level that means you can confidently draw an income from your retirement savings that is likely to last your lifetime.

Your money is always yours: You can add to or withdraw funds at any time - it's your investment, and you’re in control at all times. If you pass away, your balance will be paid to your estate.

Offers Couples Peace of Mind: By investing as a couple it means that when one person passes away, the surviving partner does not need to worry about finance immediately, as their income payments will continue as normal.

Helps you bridge the income gap: Lifetime gives you a fortnightly income to help you top up your Super and meet your regular expenses.

It’s tax effective: your income payments are paid after fees and tax.

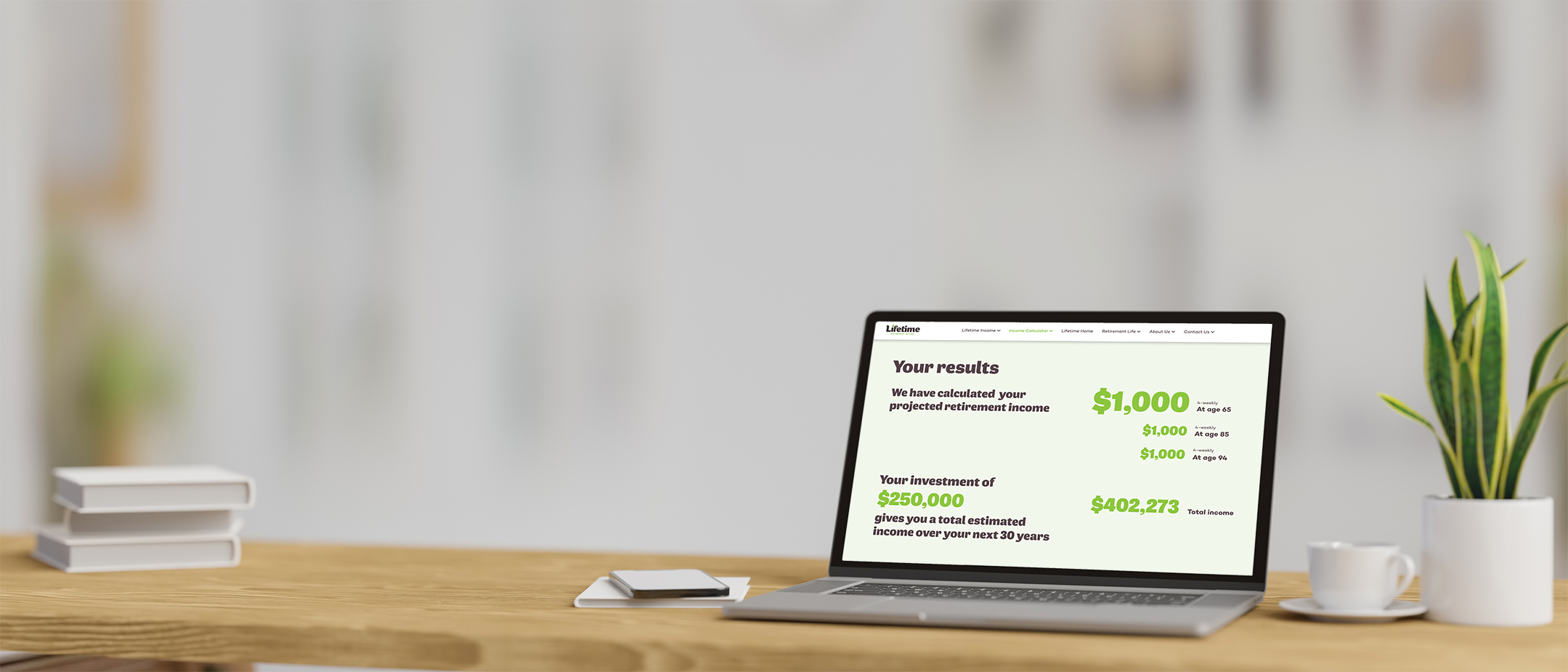

How much income could you draw in Retirement?

See how much you could receive with the Lifetime Retirement Income Calculator.

Want more information?

To gain a deeper understanding of the advantages a retirement income can offer during your retirement, explore our website or submit a request for an information pack.