May 15 2023

I like to eat my own cooking. Not literally (I’m a terrible cook!); but, when it comes to the financial topics I write and talk about, I like to do as I say. However, in one important respect I admit that I’m a fake. While I have written and talked extensively about retirement, and am well past retirement age, I have never fully retired.

Work that fits your lifestyle

I certainly work a lot less than I used to. I no longer do 60-hour weeks and have stopped doing some of those things that kept me over-busy. In particular, I have ceased giving financial advice and I no longer manage my own investments. With both of those off my plate, life is on a much more even keel, with time for an annual overseas climbing and mountaineering trip and a few other precious things.

I like my extra quiet time. Nevertheless, I have no intention of stopping work completely. On the whole, I enjoy my work (which is now mostly writing, speaking and governance) and just because I’ve had some rather arbitrary number of birthdays, I see no reason to stop.

Easing into retirement

At a recent school reunion, I found that I had company – many of my old classmates were still doing some kind of work and were happy doing so. It now seems quite common to carry on earning well past retirement age. In fact, the Retirement Commission says that 44% of people aged between 65 and 69 years old are still working.

Work provides an income, of course – but that’s not all.

Don't hang up your boots just yet

It’s true that some people need to work past retirement. Perhaps they have little or no savings, so plan to work for as long as possible to earn extra income to supplement NZ Super.

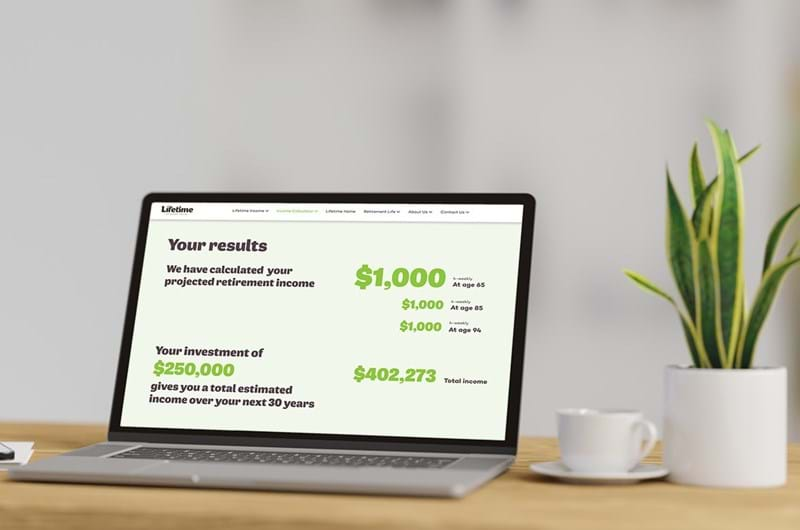

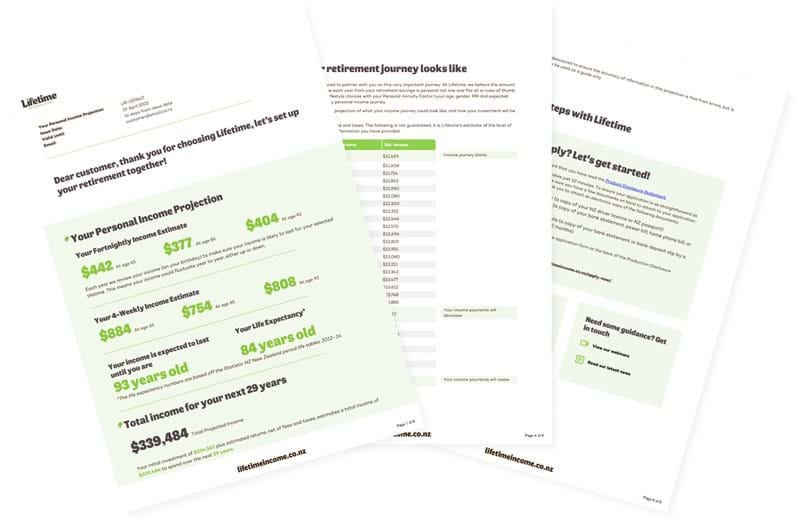

Others might have some savings, which they recognise will one day provide additional income to top up their fortnightly Super. In this case, they know that the longer they work, the more they’ll get from their savings.

Future-proofing for retirement

Clearly, they can draw more from their savings over 25 years than 30 years. Moreover, if they keep working until they’re 70, say, they are likely to have accrued more savings, through both returns on money already saved, but also from any additional income they’re able to put aside.

From a financial perspective, even a relatively small amount of work may make a big difference to your lifestyle in later years. Of course, finding the right work may not be easy – looking and applying for a job when you’re 65 can have its challenges. Ageism is alive and well. Despite our current labour shortages, I think it’s wise to avoid changing jobs in your 60s, when it might be easier to stay in the job you have than try to get a new one.

The choice is yours

Those who have enough money but choose to keep working will mostly be doing so for personal growth and lifestyle reasons: they enjoy their work, value the social connection and sense of purpose, and like to keep active and engaged. Work provides a routine that many people like – and the habits of lifetime can be hard to break!

Business owners are particularly likely to fall into this camp – they live, eat, and breath their business and have probably done so for decades. The idea of selling up can be unattractive, to say the least; it is often a much more fraught process selling a business than a house.

Then there are people who continue to work because that is who they are and that’s what they do – they simply cannot conceive of a different life.

If working or running a business is you and it is what you love, do not feel guilty. It is your life and you should live it as you want.