May 15 2023

Retirement jitters? You’re not alone.

Deciding to retire is one of life’s most important milestones. Right up there with choosing a partner, a house to buy and if/when to start a family. It’s one of those decisions that can drastically alter the course of the remainder of your life, so it’s no wonder that it makes many people feel anxious. Rest assured that if you are worried about how and when to retire, you are not alone.

The best way to deal with retirement anxiety is to look at the underlying reasons. Anxiety is usually underpinned by fear and uncertainty. Here are the most common things people worry about:

Money

Top of the list is worrying about whether you have enough saved to provide a comfortable retirement for the rest of your life. A regular income from employment provides certainty and the big question is how to replace it with a regular income from your retirement savings. It’s not easy to figure out how to invest money to generate income. Nor is it easy to work out how big your investment portfolio needs to be to generate enough income.

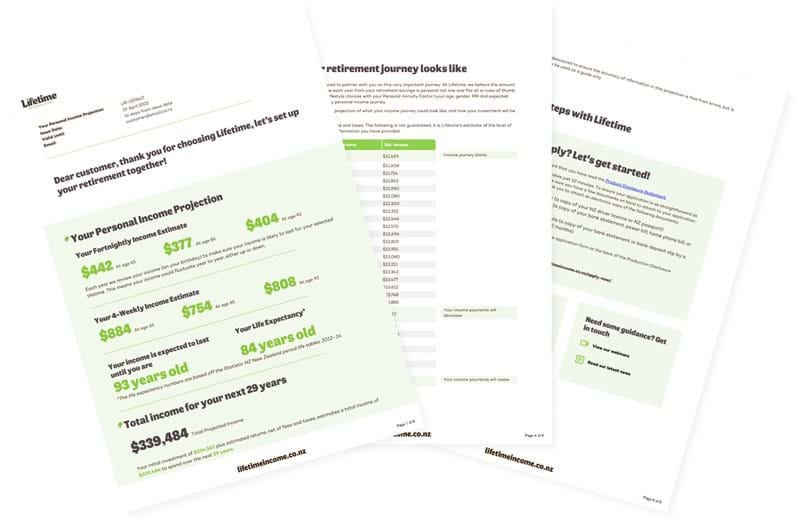

Products like the Lifetime Retirement Income Fund are designed to generate a regular income for life post work. Lifetime’s retirement income calculator provides a useful indication of how much income you could expect to receive over your lifespan.

Lifestyle changes

Retirement means a massive change in lifestyle and it’s common to be concerned about the emotional impact of this. The sudden lack of structure to the day can be unsettling. It’s great to have the freedom to choose how to spend your time, but it can also be overwhelming. Leaving the workplace also means losing social contacts. Workmates are often friends and there can be a feeling of grief when these day-to-day relationships are severed. Being outside the workforce can also spark fears of losing touch with the rest of the world.

Start laying the groundwork for your retirement.

We’ve teamed up with retirement planning expert Liz Koh to develop the Buckets of Money for Retirement planning guide.

Loss of identity and lack of purpose

We are often defined by our jobs. When we meet new people, our occupation is part of how we introduce ourselves. Our job can project the positive contribution we make to the world. It is especially hard for those with highly-respected professions, such as doctors or academics, to redefine themselves as retired. In a way, it is a loss of status in society. Being retired is somehow perceived as being old and ‘past it’, and this can cause people to delay retirement. There are also negative perceptions around being a state beneficiary on a pension.

“I went to the supermarket the other day and put my standard grocery items of bread, milk, cheese etc. into just two empty wine boxes at the checkout. The bill came to $200! I couldn’t believe it. Given today’s prices, I don’t think anyone could live on the NZ Super alone.”

Fear of regret

It’s not easy for older people to find work, so giving up a job late in life has a sense of finality about it. While some people can retire, go back to work and retire again, they are the minority.

Health

There is a real dilemma between staying in productive employment for longer and retiring to enjoy life while you are still young and healthy. This decision can cause huge stress, particularly for people who have known health conditions, or who have a much older partner they wish to travel with. Some people also worry that, once they retire, their mental capacities will diminish if they are not actively engaged.

There are many ways to overcome these anxieties. Here are just a few:

Set goals and make a plan. Retirement means setting new goals and thinking about the kind of lifestyle you want. Once you have a plan in place it’s much easier to work out how you’ll spend your time and how much money you’ll need to live comfortably. If you don’t know where to begin, take a look at the free retirement planning guide I’ve developed in collaboration with Lifetime to help you take charge of your future. You can register for this here.

Ease into retirement. It doesn’t need to be all or nothing. You can ease into retirement by working part time, or by volunteering, which also helps give you purpose.

Redefine your identity and your purpose. Your job is not your identity. You are defined by the kind of person you are and the contribution you make to your family, your friends and your community.

Strengthen your social networks. Join clubs and groups. Make an effort to build new friendships.

Embrace change, adapt and learn. Be prepared to let go of the past and give new things a go. Keep learning so your mind stays active.

Adjust your attitude. Stay positive and optimistic about the future. Acknowledge your feelings. It’s normal for a significant change in your life to impact your emotions, however they will settle down as you adjust to the change.

Get professional advice. Sometimes, all that’s needed is a little help from an expert, or confirmation that you’re on the right track. Get support where needed for your financial affairs and your emotional wellbeing.