Oct 04 2022

If you are worried or anxious about retirement, be reassured that this is quite normal, and you are not alone!

Retirement involves significant changes in just about every aspect of life. First, there is the obvious drop in income. As well, there are lifestyle changes. The daily routine becomes completely different. There can be a sense of loss of purpose – “What shall I do now?”. Retirement changes the nature and frequency of contact with people you have worked with, who may be some of your best friends. Spending more time at home with a partner may or may not be a good thing depending on how well each of you adapts to that change.

If you are newly retired or planning to retire soon, here are a few tips to help you cope with the change.

1. Expect to feel a range of different emotions.

You may feel happy, sad, confused, worried, elated and so on, all at the same time. When negative emotions kick in, find a way to restore calmness, for example, by walking, reading or catching up with friends.

2. Structure your days.

People often comment that in the first few weeks of retirement, they are at a loss as to what to do with themselves. There is no alarm clock going off, no structured time for tea or lunch breaks, and no ‘to do’ list (unless your partner has made one for you!). A good tip is to start the day with a regular habit, such as completing a crossword or other kind of puzzle. Then you can feel as though you have achieved something, and you are ready to face the day.

3. Set small goals.

Working lives are generally geared around goals, and achieving them gives a sense of satisfaction. In retirement, you can set your own goals, such as getting fit, reading the pile of books you’ve been meaning to read, or travelling to places on your wish list.

4. Grow your friendships.

It’s vital to stay connected to others. Most communities have a range of groups for retirees, for example, Probus clubs or clubs based around interests and sports such as gardening, bridge or bowls.

5. Consider getting a part-time job or doing some volunteer work.

Work activities can bring in extra income as well as provide purpose. Helping others through volunteering can give great satisfaction.

6. Give new things a try – such as a new hobby or sport.

You might need to try a few before finding something right for you.

Liz Koh

The biggest worries for people contemplating retirement are typically money worries. Have I got enough money to retire? Will I run out of money before my life ends? These are valid concerns. Retirement, for most people, lasts a very long time – up to one-third of someone’s entire life.

The best way to conquer money worries is to start by doing a retirement budget. This will be very different from the budget that applies while you are still working. The income will be lower, but so will the expenses. Transport costs will be less, you will probably eat out less, you may choose to reduce or cancel your life insurance, your clothing budget may be less and so on.

You may also be eligible for discounts (e.g. through your Gold Card) and rebates (e.g. a rates rebate). Depending on where you live, there is likely to be a gap between your NZ Superannuation and your expenses. This could be a large gap if you live in a big city.

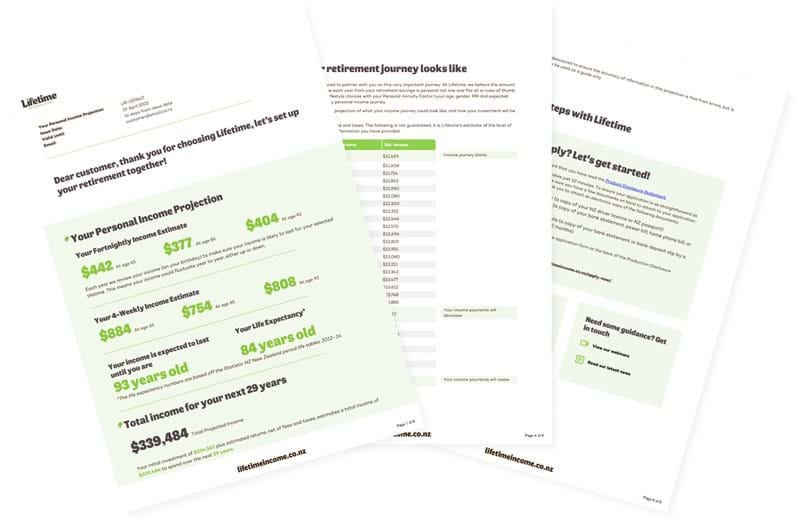

Once you have identified the gap, set aside a lump sum that you can draw on regularly to top-up your income. The Lifetime Retirement Income Fund is designed to help you manage your income top-up without fear of running out of money. A calculator is available on the website, click here to help you work out your personal income projection based on a given amount invested.

Having covered your income gap, any remaining funds can be invested to cover one-off expenses such as travel or a new car. You will need to work out what these expenses might be, so you know how much you will need in total for your retirement.

Of course, not everybody has sufficient funds to pay for absolutely everything they want or need in retirement. It’s a matter of cutting your cloth to suit the available funds and ensuring you can at least cover the basics before you stop working. Planning ahead is the best way to take care of worries.