Sep 14 2022

Different generations of workers (often) have different needs.

As each generation is in a different stage of their lives, it’s no surprise that they tend to appreciate different types of employee benefits. Understandably, young Millennial parents have other priorities than a close-to-retirement Baby Boomer.

The Benify study separates employee benefits into categories that employees find most important and those they most appreciate. Let’s see what the overview looks like for each generation.

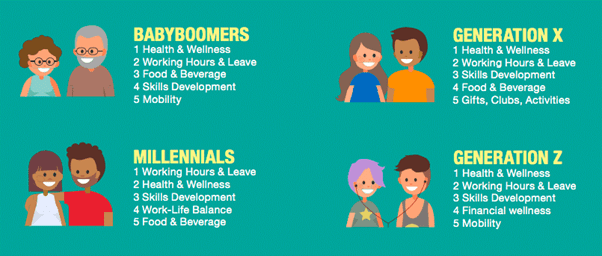

Most important benefits among the different generations in the workplace.

Benify, Employee Happiness Index 2019. Click here to read more

Two things immediately stand out when we consider what benefits people find necessary.

- The first and perhaps the most obvious one is that superannuation plans gain importance as the generation ages; this makes sense as graduates who have just entered the workforce probably won’t be thinking about their retirement in 40-plus years.

- The second thing worth noticing here is skills development. Unsurprisingly, developing new skills is more important for younger generations, as they will be more affected by technological developments than Baby Boomers.

Regardless of their age, something that tops almost every employee’s list is working hours and leave.

Most appreciated benefits among the different generations in the workplace.

Benify, Employee Happiness Index 2019. Click here to read more

When we look at the benefits employees most appreciate, the top five per generation look slightly different. Suddenly, benefits like food and beverage and mobility pop up on various lists. However, the number one appreciated benefit among almost all of the generations is health and wellness.

It’s interesting to see that financial wellness is something that the youngest generation in the workforce, Generation Z, has in its top five. As companies increasingly hire people from Generation Z, financial wellness will likely become a more critical employee benefit.

The survey shows that health and wellness and financial wellness are high on the list for all generations. Our advisers at First Capital Financial Services often discuss these factors with employers when planning the design and implementation of a comprehensive employee benefits solution.

Employers can build a competitive advantage by attracting and retaining valued, productive and loyal staff. Employers of choice demonstrate their commitment to their teams by providing an employee benefits package to assist staff and families when needed.

First Capital Financial Services

This article was provide by First Capital Financial Services, who can assist employers in creating a more secure future for their staff through group insurance schemes such as life, disability and serious illness cover or group medical insurance schemes.

Our corporate client portfolio ranges from some of the largest companies in New Zealand to smaller employers. We have years of experience managing the needs of all sizes of business.

The key to ensuring employee benefits programmes are successful is to provide regular, easy-to-understand communications on what is being provided and to be on-site to address individual issues and help employees understand the benefits offered.

Once you have identified the gap, set aside a lump sum that you can draw on regularly to top-up your income. The Lifetime Retirement Income Fund is designed to help you manage your income top-up without fear of running out of money. A calculator is available on the website, click here to help you work out your personal income projection based on a given amount invested.

Having covered your income gap, any remaining funds can be invested to cover one-off expenses such as travel or a new car. You will need to work out what these expenses might be, so you know how much you will need in total for your retirement.

Of course, not everybody has sufficient funds to pay for absolutely everything they want or need in retirement. It’s a matter of cutting your cloth to suit the available funds and ensuring you can at least cover the basics before you stop working. Planning ahead is the best way to take care of worries.